Table Of Content

The larger your down payment, the lower your mortgage default insurance premiums — another reminder of how much your down payment savings can impact mortgage affordability. The maximum GDS limit used by most lenders to qualify borrowers is 39% and the maximum TDS limit is 44%. Our mortgage calculator uses these maximum limits to estimate affordability.

Mortgage details

A lower interest rate can make a mortgage much less expensive, while a higher rate could put a house out of your price range. If you’ve served in the military, you may qualify for a VA loan, which can come with attractive interest rate offers and lower down payment requirements. In fact, you may be able to qualify for a VA loan without putting any money down. When a loan exceeds a certain amount (the conforming loan limit), it's not insured by the Federal government. Jumbo loans allow you to purchase more expensive properties but often require 20% down, which can cost more than $100,000 at closing.

Living Expenses

Our partners cannot pay us to guarantee favorable reviews of their products or services. As a result, Army leaders recently told Congress that without passage of the foreign aid bill, they will begin to run out of money and have to move funds from other accounts. Those systems cost more to replace, so the military — in particular, the Army — went deeper into debt. Compounding that, the military in some cases opted to replace older systems sent to Ukraine with pricier, higher-tech ones at home.

Conventional Loans and the 28/36 Rule

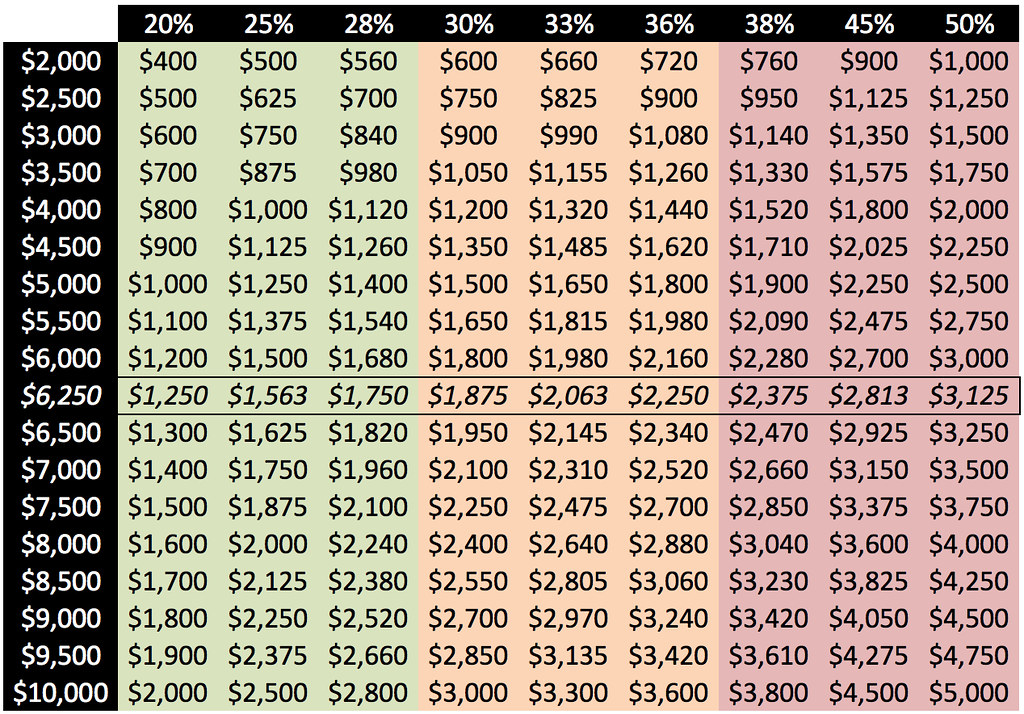

However, this loan typically requires private mortgage insurance (PMI) which should be added into your monthly expenditures. PMI is usually .05-1% of the cost of the home loan but may vary depending on credit score. The table above used $600 as a benchmark for monthly debt payments, based on average $400 car payment and $200 in student loan or credit payments.

If your loan amount is greater than 80% of the home purchase price, lenders require insurance on their investment. Use Zillow’s home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, home insurance and HOA fees. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. If you are taking out a conventional loan and you put down less than 20%, private mortgage insurance will take up part of your monthly budget. The PMI’s cost will vary based on your lender, how much money you end up putting down, as well as your credit score. It is calculated as a percentage of your total loan amount, and usually ranges between 0.58% and 1.86%.

How to improve mortgage affordability

You’ll also need to factor in how mortgage insurance premiums — required on all FHA loans — will impact your payments. Take account of your financial readiness to buy a house by applying the 28/36 rule. Lenders generally want to see that when you add up your principal, interest, taxes and insurance, it totals less than 28% of your gross monthly income. Lenders also generally want to see that those housing costs plus other debt (i.e. auto loans) are less than 36% of your gross monthly income.

The 28/36 rule - what it is and how it works

Lenders don’t have a complete picture of your financial situation, despite all the paperwork they ask for. While housing prices have jumped nationally, they can still vary widely in terms of affordability when broken down by local area. If you have a VA loan, guaranteed by the Department of Veterans Affairs, you won’t have to put anything down or pay for mortgage insurance, but you will have to pay a funding fee.

In larger U.S. cities, affording a home is tough even for people with higher income - CBS News

In larger U.S. cities, affording a home is tough even for people with higher income.

Posted: Thu, 18 Jan 2024 08:00:00 GMT [source]

Down payment

In her spare time, Miranda enjoys traveling, actively engages in the entrepreneurial community, and savors a perfectly brewed cup of coffee. As you determine how much house you can afford, remember to factor in down payments, especially if you’re trying to afford the 20% to avoid PMI. Note that you might not have to put down anything at all if you qualify for certain government loans. The Rocket Mortgage® Home Affordability Calculator gives you the option to see how much house you can afford, or how much cash you need for your down payment and closing costs.

What is mortgage affordability?

When lenders evaluate your ability to afford a home, they take into account only your present outstanding debts. They do not take into consideration if you want to set aside $250 every month for your retirement or if you’re expecting a baby and want to save additional funds. Buying a home remains a primary wealth-building tool for U.S. households, but rising home prices have placed homeownership increasingly out of reach for the average American. To comfortably afford a typical home, Americans today must have household income of $106,500 — up sharply from $59,000 just four years ago, according to Zillow research. The average interest rate on a fixed 30-year home loan rose to 7.1%, marking the first time this year rates have topped 7%, according to Freddie Mac. Meanwhile, the median asking price for U.S. home — what homeowners hope their property will sell for — jumped to a record $415,925 for the four weeks ended April 21, Redfin said.

However, if you are considering a smaller down payment, down to a minimum of 3.5%, you might apply for an FHA loan. Home prices have escalated in part because of a lack of available for-sale properties. Learn more about how to figure out how much you can spend on a mortgage and use our home affordability calculator here. Considering these factors, carefully comparing lenders' rates and terms helps you make an informed choice, secure an initially favorable rate and avoid hidden costs tied to rate fluctuations. When evaluating the affordability of a home under an FHA loan, several crucial factors come into play, impacting your financial readiness for the home buying journey.

For homes worth between $500,000 and $999,999, you’ll have to put 5% down on the amount up to $500,000 and 10% on the amount over $500,000. Homes worth $1 million or more require a down payment of at least 20%. Mortgage affordability depends on several economic factors — only some of which you can control — as well as Canada’s strict rules around mortgage lending. Using our Mortgage Affordability Calculator, a home buyer the above criteria would qualify for a property with a maximum purchase price of $284,876. For more on the types of mortgage loans, see How to Choose the Best Mortgage.

No comments:

Post a Comment